http://content.usatoday.com/communities/theoval/post/2009/10/68501001/1#.T_r1P5F2GcY

Monthly Archives: July 2012

Americans Making Over $50,000 a Year Paid 93.3 % of All Taxes in 2010

Always keep in mind the difference between the productive middle class, the rich and the super rich – LINK – LINK – LINK – LINK. The Democrat leadership makes like there is no difference for reasons you will discover in that list of links.

Americans making over $50,000 paid most of the federal taxes that were paid in the U.S. in 2010.

According to statistics compiled from the Internal Revenue Service (IRS) by the Tax Foundation, those people making above $50,000 had an effective tax rate of 14.1 percent, and carried 93.3 percent of the total tax burden.

In contrast, Americans making less than $50,000 had an effective tax rate of 3.5 percent and their total share of the tax burden was just 6.7 percent.

Americans making more than $250,000 had an effective tax rate of 23.4 percent and their total share of the tax burden was 45.7 percent.

Out of the 143 million tax returns that were filed with the IRS in 2010, 58 million – or 41 percent – of those filers were non-payers.

In other words, only 85 million actually paid taxes.

But Tax Foundation data also shows that people who didn’t pay any income tax received $105 billion in refundable tax credits from the IRS.

Additionally, statistics from the Tax Foundation shows that the federal tax code is 3.8 million words long – 3.5 times longer than all seven books of J.K. Rowling’s famous Harry Potter series combined.

According to Scholastic.com, the total word count of all seven Harry Potter books is 1,083,594 words with Harry Potter and the Sorcerer’s Stone being the shortest (76,944 words) and Harry Potter and the Order of the Phoenix the longest (257,045).

In contrast, the federal tax code is 3.8 million words, almost a tripling of its size since 2001 when the Joint Committee on Taxation estimated the tax code to be 1,395,000, and almost doubling its size since the Tax Foundation’s estimates in 2001.

Top Global Warming Alarmist Scientist Admits: I Made a Mistake

…and Al Gore is Guilty of exaggerating his arguments..

Environmental scientist James Lovelock, renowned for his terrifying predictions of climate change’s deadly impact on the planet, has gone back on his previous claims, admitting they were ‘alarmist’.

The 92-year-old Briton, who also developed the Gaia theory of the Earth as a single organism, has said climate change is still happening – just not as quickly as he once warned.

He added that other environmental commentators, such as former vice president Al Gore, are also guilty of exaggerating their arguments.

The admission comes as a devastating blow to proponents of climate change who regard Lovelock as a powerful figurehead.

Five years ago, he had claimed: ‘Before this century is over billions of us will die and the few breeding pairs of people that survive will be in the Arctic where the climate remains tolerable.’

But in an interview with msnbc.com, he admitted: ‘I made a mistake.’

He said: ‘The problem is we don’t know what the climate is doing,’ he told ‘We thought we knew 20 years ago. That led to some alarmist books – mine included – because it looked clear cut, but it hasn’t happened.

ObamaCare creates 13,000 pages of new regulations and they aren’t done yet…

And some people are still foolish enough to believe that adding such a bureaucratic overhead will eventually lower healthcare costs and premiums, of course the CBO and the Medicare Actuary have already said that ObamaCare makes the problem worse.

With the Supreme Court giving President Obama’s new health care law a green light, federal and state officials are turning to implementation of the law — a lengthy and massive undertaking still in its early stages, but already costing money and expanding the government.

The Health and Human Services Department “was given a billion dollars implementation money,” Republican Rep. Denny Rehberg of Montana said. “That money is gone already on additional bureaucrats and IT programs, computerization for the implementation.”

“Oh boy,” Stan Dorn of the Urban Institute said. “HHS has a huge amount of work to do and the states do, too. There will be new health insurance marketplaces in every state in the country, places you can go online, compare health plans.”

The IRS, Health and Human Services and many other agencies will now write thousands of pages of regulations — an effort well under way:

“There’s already 13,000 pages of regulations, and they’re not even done yet,” Rehberg said.

“It’s a delegation of extensive authority from Congress to the Department of Health and Human Services and a lot of boards and commissions and bureaus throughout the bureaucracy,” Matt Spalding of the Heritage Foundation said. “We counted about 180 or so.”

There has been much focus on the mandate that all Americans obtain health insurance, but analysts say that’s just a small part of the law — covering only a few pages out of the law’s 2700.

“The fact of the matter is the mandate is about two percent of the whole piece of the legislation,” Spalding said. “It’s a minor part.”

Much bigger than the mandate itself are the insurance exchanges that will administer $681 billion in subsidies over 10 years, which will require a lot of new federal workers at the IRS and health department.

“They are asking for several hundred new employees,” Dorn said. “You have rules you need to write and you need lawyers, so there are lots of things you need to do when you are standing up a new enterprise.”

For some, though, the bottom line is clear and troubling: The federal government is about to assume massive new powers.

According to James Capretta of the Ethics and Public Policy Center, federal powers will include designing insurance plans, telling people where they can go for coverage and how much insurers are allowed to charge.

“Really, how doctors and hospitals are supposed to practice medicine,” he said.

Read more HERE.

MUST SEE: ObamaCare’s Impact on YOU (video)

You know that the elite media in the United States has failed us when Russia Today (AKA “RT”) – the mouthpiece for Vladimir Putin – gives the best analysis I have yet seen on a major network (granted RT isn’t huge in the United States, but around the world it is). Russia Today not only explains why the Roberts ruling is preposterous as a matter of law, and then explains several of the economic consequences of ObamaCare. This very writer has called out Russia Today as a mouthpiece for Putin before, but with that said, in this segment Russia Today displays one of the finest pieces of television journalism I have ever seen.

Russia Today has an agenda of showing the United States as authoritarian, silly, corrupt, willing to break its own laws, and anything but small government. Russia Today doesn’t have to make it up any more with the Obama Administration because all they have to do is highlight and accurately cover the stories the elite media will not to accomplish Putin’s goals.

Our friend Samantha Frederickson has a GREAT post explaining the consequences of ObamaCare that will impact you after the clip from Russia Today below. Start the video at the 2:00 mark:

Now consider this — the PPACA sets forth a “fine” (tax) of $2,000 per employee for a business that has 50 or more and does not provide “at least” the minimum “insurance” to all.

There is no health care plan I’m aware of that a business can buy today that costs less than $2,000 per employee per year, and which also meets the requirements in the law. None. That was almost impossible to meet back in 1995 for a healthy, 18 year old insured single male. It’s flatly impossible now and it’s doubly-so if your workforce has other than 18-year old single, healthy males in it. I know this to be factual because I was responsible for buying it for our employees as a CEO of a company.

Therefore the incentive is for all businesses to drop health care.

Period.

Second, your choice is to either (1) buy and have said plan (whether through employment or individually) or pay a “fine” (tax) of 1% of income (increasing to 2.5% of AGI in 2016.) The minimum “fine” is $95 starting in 2013, rising to $695 in 2016. The average family income is about $50,000/year, which means that the fine (tax) will be $1,250 in 2016. It’s less now.

You cannot buy health insurance at their “minimum level” for anything approaching $1,250 a year no matter how healthy you are at any age.

The law prohibits insurance companies from charging you more if you’re sick, or refusing to cover you at all. They must accept everyone on equal terms.

Therefore:

- Businesses will drop coverage; it’s cheaper (by far) for them to pay the fine and, for those under 133% of the federal poverty level, those employees can go onto Medicaid. This is a “family of four” income of $31,900 (as of today; it will go up of course.) That’s roughly the second quintile.

- Individuals will drop coverage and pay the fine, since it’s far cheaper than to buy the “insurance.”

Both will buy the “insurance” only when they get sick, since they cannot be upcharged.

The cost of “insurance” will thus skyrocket to 10x or more what it costs now, just as it would if you bought auto insurance only after you wrecked or homeowners insurance only after you had a fire.

At the higher price nobody will be able to afford to buy the insurance at all, since that will be indistinguishable from just paying for whatever is wrong with you, plus the insurance company markup.

In very short order the entire medical system and health insurance scheme will collapse, leaving only two choices — either a return to free market principles (including all I’ve argued for since this debate began) or a single-payer, fully-socialized system ala Canada.

You can bet the government will continue to try to change the terms of the deal — including ramping up the tax/fine and other games, to prevent this outcome, but they will fail.

Now the question becomes this:

Which Presidential political candidates have told you the above, and what are their answers to this dilemma?

Let’s go down the list.

- We know what Obama’s is — he passed it. You will lose your private health care under Obama. Period. We are headed for a fully-socialized medical system and a collapse of the current medical paradigm under Obama.

- We know what Gary Johnson’s position is — he wants to “block grant” all Medicare and Medicaid to the states, cut the amount of money in the budget (all line items) 43% and repeal Obamacare (including the mandate.) But he refuses to demand an end to the cost-shifting where Juanita the illegal Mexican immigrant who is 7-1/2 months pregnant while drug and alcohol dependent shows up in the hospital, in labor, and foists off a $2.5 million NICU and birth expense bill on you! He also refuses to stop the drug companies from effectively forcing Americans to bear the cost of all drug and device development and he has refused to put a stop to differential billing. The latter two only exist because of explicit federal laws that make lawful in the health industry market behaviors that are illegal in virtually every other line of work (see The Sherman Act, The Clayton Act, and Robinson-Patman for starters.) All of these facts are why the costs are ramping in the first place, which means his plan will simply force the States into bankruptcy and continue screwing you at the same time.

- We don’t know what Romney’s plan is in detail. He’s been oddly silent in that regard. He says “Obamacare is not the answer” but he passed it as Governor on a state basis! He too advocates nothing to put a stop to the cost-shifting and anti-competitive acts of drug and device makers nor hospitals and other medical providers. He too wants to block grant Medicaid but that does nothing to address the problem and will simply bankrupt the state budgets (as noted for Johnson.) Conspicuously absent from Romney’s plan (as is true for Johnson) is (1) a repeal of EMTALA, (2) a demand for level, consistent pricing irrespective of how one pays for a service (3) and a demand to remove anti-competitive laws protecting differential billing across state and national boundaries (e.g. Viagra for $2 in Canada .vs. $20 here) so that Americans are not forced to subsdize everyone else in the world and you pay the same price as the guy next to you in the hospital for the same product or service, instead of 2x, 3x, 5x, or even 100x as much.

So we have three Presidential candidates, none of which will do a damn thing to fix what’s wrong with health care. All three are promoting a path that will bankrupt the States, bankrupt the Federal Government, bankrupt you or all three.

All three are promoting mathematical impossibilities. All three are protecting monopolistic behavior and refusing to address specific laws that were passed to protect that behavior and special government-granted privilege; without those protections that monopolistic behavior would immediately collapse.

And worse, none of them has proposed a damn thing to deal with what the Supreme Court just did, which is grant a permanent ability to the Federal Government to compel any behavior by linking it to a tax. Some examples of where this can (and might in the near future!) go include:

- You make cars. You’re told to sell a car to anyone who makes under $25,000 a year for $5,000. This is of course under your cost of production. If you refuse, every car you make is subject to a $5,000 tax. This is now Constitutional, as of this last week.

- You would like to have three kids. The government decides that you may have only two. If you have get pregnant with a third and refuse to have an abortion you must pay $10,000 a year in additional tax forever. This is now Constitutional, as of last week.

- You may have all the abortions you want, but each costs $10,000 in tax. This is Constitutional, as of last week.

- You must eat Broccoli and submit receipts with your 1040 proving you bought 1lb of Broccoli per person in your household per week. If you do not, you must pay $5,000 in additional tax. This is Constitutional, as of last week.

- If you are more than 10lbs overweight you must pay $2,000 of additional tax for every 10lbs overweight you are, with no cap. This is Constitutional, as of last week.

You probably think I’m kidding on this. I’m not. This is what the Roberts Court held. There is literally nothing that Congress cannot mandate that you do, or not do, under penalty of paying a tax. All that was unconstitutional before the ruling now is explicitly constitutional if the only “compulsion” to do (or not do) a given thing is that you will be taxed if you refuse. The court promised to review “reasonableness” of any such taxes in the future, but note that at the same time the court ignored two other problems with the Health Care law, making a lie of their claim of “future reasonableness” tests right up front:

- Direct taxes are unconstitutional without being apportioned. This is clearly a direct tax and it is not apportioned. It is therefore unconstitutional, but the USSC simply ignored this. (The 16th Amendment was required to make income taxes constitutional for this reason.)

- The Anti-Injunction Act prohibits suing the government over a tax until you have actually paid it. This means that if the PPACA “penalty” is a tax then the entire lawsuit that went to the USSC is moot as it’s not yet “ripe” (since nobody has yet paid the tax.) If they were going to find that this was a tax they were thus bound to dismiss the entire complaint as unripe. They ignored that too.

In short the USSC has become no more legitimate than the North Korean government and is unworthy of your respect.

Prof. Paul Moreno: A Short History of Congress’s Power to Tax

The case against Roberts’ preposterous ruling just keeps building.

The Supreme Court has long distinguished the regulatory from the taxing power.

In 1935, Secretary of Labor Frances Perkins was fretting about finding a constitutional basis for the Social Security Act. Supreme Court Justice Harlan Fiske Stone advised her, “The taxing power, my dear, the taxing power. You can do anything under the taxing power.”

Last week, in his ObamaCare opinion, NFIB v. Sebelius, Chief Justice John Roberts gave Congress the same advice—just enact regulatory legislation and tack on a financial penalty, as in failure to comply with the individual insurance mandate. So how did the power to tax under the Constitution become unbounded?

The first enumerated power that the Constitution grants to Congress is the “power to lay and collect taxes, duties, imposts, and excises, to pay the debts and provide for the common defense and general welfare of the United States.” The text indicates that the taxing power is not plenary, but can be used only for defined ends and objects—since a comma, not a semicolon, separated the clauses on means (taxes) and ends (debts, defense, welfare).

This punctuation was no small matter. In 1798, Pennsylvania Rep. Albert Gallatin said that fellow Pennsylvania Rep. Gouverneur Morris, chairman of the Committee on Style at the Constitutional Convention, had smuggled in the semicolon in order to make Congress’s taxing power limitless, but that the alert Roger Sherman had the comma restored. The altered punctuation, Gallatin said, would have turned “words [that] had originally been inserted in the Constitution as a limitation to the power of levying taxes” into “a distinct power.” Thirty years later, Virginia Rep. Mark Alexander accused Secretary of State John Quincy Adams of doing the same thing after Congress instructed the administration to print copies of the Constitution.

The punctuation debate simply reinforced James Madison’s point in Federalist No. 41 that Congress could tax and spend only for those objects enumerated, primarily in Article I, Section 8.

Congress enacted very few taxes up to the end of the Civil War, and none that was a pretext for regulating things that the Constitution gave it no power to regulate. True, the purpose of tariffs was to protect domestic industry from foreign competition, not raise revenue. But the Constitution grants Congress a plenary power to regulate commerce with other nations.

Congress also enacted a tax to destroy state bank notes in 1866, but this could be seen as a “necessary and proper” means to stop the states from usurping Congress’s monetary or currency power. It was upheld in Veazie Bank v. Fenno (1869).

The first unabashed use of the taxing power for regulatory purposes came when Congress enacted a tax on “oleomargarine” in 1886. Dairy farmers tried to drive this cheaper butter substitute from the market but could only get Congress to adopt a mild tax, based on the claim that margarine was often artificially colored and fraudulently sold as butter. President Grover Cleveland reluctantly signed the bill, saying that if he were convinced the revenue aspect was simply a pretext “to destroy . . . one industry of our people for the protection and benefit of another,” he would have vetoed it.

Congress imposed another tax on margarine in 1902, which the Supreme Court upheld (U.S. v. McCray, 1904). Three justices dissented, but without writing an opinion.

Then, in 1914, Congress imposed taxes on druggists’ sales of opiates as a way to regulate their use. Five years later, in U.S. v. Doremus , the Supreme Court upheld the levy under Congress’s express power to impose excise taxes.

Then, in 1922, the court rejected Congress’s attempt to prohibit child labor by imposing a tax on companies that employed children. An earlier attempt to accomplish this, by prohibiting the interstate shipment of goods made by child labor, was struck down as unconstitutional—since it was understood since the earliest days of the republic that Congress had the power to regulate commerce but not manufacturing. “A Court must be blind not to see that the so-called tax is imposed to stop the employment of children within the age limits prescribed,” Chief Justice William Howard Taft wrote in Bailey v. Drexel Furniture Co. “Its prohibitory and regulatory effect and purpose are palpable.” Even liberal justices Oliver Wendell Holmes and Louis D. Brandeis concurred in Taft’s opinion.

Things came to a head in the New Deal, when Congress imposed a tax on food and fiber processors and used those tax dollars to provide benefits to farmers. Though in U.S. v. Butler (1936) the court adopted a more expansive view of the taxing power—allowing Congress to tax and spend for the “general welfare” beyond the powers specifically enumerated in the Constitution—it still held the ends had to be “general” and not transfer payments from one group to another. After President Franklin D. Roosevelt threatened to “pack” the Supreme Court in 1937, it accepted such transfer payments in Mulford v. Smith (1939), so long as the taxes were paid into the general treasury and not earmarked for farmers.

And now, in 2012, Justice Roberts has confirmed that there are no limits to regulatory taxation as long as the revenue is deposited in the U.S. Treasury.

Are there any other limits? Article I, Section 2 says that “direct taxes shall be apportioned among the states” according to population. This is repeated in Article I, Section 9, which says that “no capitation, or other direct tax, shall be laid,” unless apportioned.

The Supreme Court struck down income taxes in 1895 (Pollock v. Farmers’ Loan & Trust Co.), on the ground that they were “direct” taxes but not apportioned by population. Apportioning an income tax would defeat the purpose of the relatively poorer Southern and Western states, who wanted the relatively richer states of the Northeast to pay the bulk of the tax. The 16th Amendment gave Congress the power to tax incomes without apportionment.

Other direct taxes should presumably have to be apportioned according to the Constitution. Justice Roberts quickly dismissed the notion that the individual mandate penalty-tax is not a direct tax “under this Court’s precedents.” To any sentient adult, it looks like a “capitation” or head tax, imposed upon individuals directly. Unfortunately, having plenty of other reasons to object to ObamaCare, the four dissenting justices in NFIB v. Sebelius did not explore this point.

Some conservatives have cheered that part of Justice Roberts’s decision that limits Congress’s Commerce Clause power. But an unlimited taxing power is equally dangerous to constitutional government.

Mr. Moreno is a professor of history at Hillsdale College and the author of “The American State from the Civil War to the New Deal,”

Mark Steyn: A lie makes Obamacare legal

Three months ago, I quoted George Jonas on the 30th anniversary of Canada’s ghastly “Charter of Rights and Freedoms”: “There seems to be an inverse relationship between written instruments of freedom, such as a Charter, and freedom itself,” wrote Jonas. “It’s as if freedom were too fragile to be put into words: If you write down your rights and freedoms, you lose them.”

For longer than one might have expected, the U.S. Constitution was a happy exception to that general rule – until, that is, the contortions required to reconcile a republic of limited government with the ambitions of statism rendered U.S. constitutionalism increasingly absurd. As I also wrote three months ago (yes, yes, don’t worry, there’s a couple of sentences of new material in amongst all the I-told-you-so stuff), “The United States is the only Western nation in which our rulers invoke the Constitution for the purpose of overriding it – or, at any rate, torturing its language beyond repair.”

Thus, the Supreme Court’s Obamacare decision. No one could seriously argue that the Framers’ vision of the Constitution intended to provide philosophical license for a national government (“federal” hardly seems le mot juste) whose treasury could fine you for declining to make provision for a chest infection that meets the approval of the Commissar of Ailments. Yet on Thursday, Chief Justice John Roberts did just that. And conservatives are supposed to be encouraged that he did so by appeal to the Constitution’s taxing authority rather than by a massive expansion of the Commerce Clause. Indeed, several respected commentators portrayed the Chief Justice’s majority vote as a finely calibrated act of constitutional seemliness.

Great. That and $4.95 will get you a decaf macchiato in the Supreme Court snack bar. There’s nothing constitutionally seemly about a court decision that says this law is only legal because the people’s representatives flat-out lied to the people when they passed it. Throughout the Obamacare debates, Democrats explicitly denied it was a massive tax hike: “You reject that it’s a tax increase?” George Stephanopoulos demanded to know on ABC. “I absolutely reject that notion,” replied the President. Yet “that notion” is the only one that would fly at the Supreme Court. The jurists found the individual mandate constitutional by declining to recognize it as a mandate at all. For Roberts’ defenders on the right, this is apparently a daring rout of Big Government: Like Nelson contemplating the Danish fleet at the Battle of Copenhagen, the Chief Justice held the telescope to his blind eye and declared, “I see no ships.”

If it looks like a duck, quacks like a duck, but a handful of judges rule that it’s a rare breed of elk, then all’s well. The Chief Justice, on the other hand, looks, quacks and walks like the Queen in Alice In Wonderland: “Sentence first – verdict afterwards.” The Obama administration sentences you to a $695 fine, and a couple of years later the queens of the Supreme Court explain what it is you’re guilty of. A. V. Dicey’s famous antipathy to written constitutions and preference for what he called (in a then-largely unfamiliar coinage) the “rule of law” has never looked better.

Instead, constitutionalists argue that Chief Justice Roberts has won a Nelson-like victory over the ever-expanding Commerce Clause. Big deal – for is his new, approved, enhanced taxing power not equally expandable? And, in attempting to pass off a confiscatory penalty as a legitimate tax, Roberts inflicts damage on the most basic legal principles.

Bingo on that last line. To read the rest of Mark Steyn’s excellent column click HERE.

Seven Truths About Politicians

It is pieces like this that make me regret that I do not have much time to write original pieces anymore. In this piece John Hawkins gives us an all important reminder of what those of us who are politically aware often take for granted.

1) The first priority of a politician is always getting re-elected: As Thomas Sowell has noted,

“No one will really understand politics until they understand that politicians are not trying to solve our problems. They are trying to solve their own problems — of which getting elected and re-elected are number one and number two. Whatever is number three is far behind.”

Politicians may care about sticking to the Constitution, doing what’s right for the country, and keeping their promises, but all of those issues pale in importance to staying employed in their cushy jobs.

2) Most politicians care far more about the opinions of interest groups than their constituents: Because of gerrymandering and America’s partisan fault lines, even under the worst of circumstances, 75% of the politicians in Congress are in no danger of losing their seats to a candidate of the opposing party. Furthermore, because of their advantages in name recognition, fund raising, and the fealty of other local politicians to someone they view as a likely winner, most challengers from the same party have little hope of unseating an incumbent either.

The only way that changes is if an incumbent infuriates an interest group on his own side that has the money and influence to help a challenger mount a credible campaign against him. That’s why politicians in non-competitive districts are far more afraid of groups like Freedomworks or the SEIU than their own constituents. Incumbents can — and often do, crap all over their own constituents without fear of losing their jobs. However, if they infuriate an interest group, they may end up in the unemployment line.

3) You shouldn’t ever take a politician at his word: People say they want a politician who’ll tell the truth. Unfortunately, that’s not true. What people actually want is a politician who’ll tell them what they want to hear and call that the truth. [Emphasis ours – Political Arena Editor] Partisans on both sides of the aisle have very little tolerance for politicians who deviate from accepted ideology; so the politicians get around that by lying. Most (but of course, not all) of the politicians championed by the Tea Party? They think the Tea Partiers are riff-raff, but useful riff-raff; so they cater to us. It’s no different on the Left. Most of the politicians who talk up the Occupy Movement think they’re damn, dirty hippies. They’re just useful damn, dirty hippies. That doesn’t mean no politician is ever “one of us,” but they are few and far between.

4) Most members of Congress aren’t particularly competent: On average, the politicians in Congress are generally well meaning, a little smarter than average, a lot more connected, and wealthy — but also considerably less ethical. Beyond that, they’re mostly just like a random subsection of a population. If you had a hundred random Americans in a room, a senator probably wouldn’t be the smartest person there, the person you’d want in charge, or even necessarily one of the more useful people to have around. In many respects, politicians are FAR LESS COMPETENT than the average person because so many of them led pampered, sheltered lives before they got into Congress and then have had their behinds kissed incessantly from the moment they got into power.

5) Members of Congress are out of touch: First off, even if members of Congress care about what their constituents think, they spend most of their time in D.C., not back home. Meanwhile, the median net worth of members of Congress is about $913,000. On top of that, members of Congress have staffers who do everything for them and treat them like god-kings in the process. These aides schedule their lives, read everything for them and regurgitate back what they think they need, and incessantly tell them how wonderful they are. Most members of Congress have more in common with celebrities like Madonna or Barbra Streisand than they do with the teachers, factory workers, and small business owners who vote them into office.

6) Few of them will do anything to limit their own power: It doesn’t matter if you’re talking about big government liberals or small government conservatives, very, very few politicians are interested in doing anything that will limit their own power. That’s why term limits for Congress have never passed. It’s why the ethics rules in the House and Senate are a bad joke. It’s also a big part of the reason why government gets bigger, more expensive, and more powerful no matter who’s in charge. If you expect to reduce the concentration of power in D.C. by electing different politicians, then ultimately you’re going to find that you’re barking up the wrong tree.

7) Most politicians only do the right thing because they’re forced to do it: As the late, great Milton Friedman once said,

“I do not believe that the solution to our problem is simply to elect the right people. The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing. Unless it is politically profitable for the wrong people to do the right thing, the right people will not do the right thing either, or if they try, they will shortly be out of office.”

If you want to change how politicians behave, then you have to change public opinion, build structural limits into the system that force changes, or make politicians fear for their jobs. If people are hoping politicians will do the right thing, just because it is the right thing, then they’re hoping in vain.

Explanation of the ObamaCare Ruling for the Non-lawyer

Faust:

Again, if you’re confused, you’re not alone. The mandate is not a tax when Roberts doesn’t want it to be and it is a tax when he wants it to be. That’s confounding enough. But what’s worse is that nowhere in the opinion does he state what of the three types of taxes the mandate is.

Folks you might notice that this is exactly what we said a few hours after the ruling came out LINK. To see part II of Faust’s excellent explanation of the ruling HERE – Editor

By Jason Faust Attorney at Law:

There were four issues presented for a ruling to the Supreme Court in the Obamacare case:

- Whether the Anti-Injunction Act precluded the Court from even hearing the case in the first place.

- Whether the individual mandate was a constitutional exercise of Congress’ power.

- Whether it was constitutional for the federal government to withhold all Medicaid funds from states which refused to comply with the ACA’s expansion of Medicaid.

- If any provision of the Affordable Care Act (ACA) was unconstitutional, could it be severed from the rest of the Act or must that make the entire Act unconstitutional?

Each issue will be analyzed separately. This article will discuss the first two issues presented. A soon-to-follow article will discuss the second two issues presented as well as a discussion of what this means in practical terms.

The Supreme Court ruled that the “penalty” in 26 U.S.C. Section 5000A (the individual mandate) is NOT a tax for purposes of the Anti-Injunction Act.

As the Supreme Court explained, “The Anti-Injunction Act provides that ‘no suit for the purpose of restraining the assessment or collection of any tax shall be maintained in any court by any person,’ 26 U. S. C. §7421(a), so that those subject to a tax must first pay it and then sue for a refund.” In other words, one cannot sue to prevent the imposition of tax unless and until that tax has already been levied against an individual. Only after the tax is levied and paid can an individual sue the government for a refund of the tax on the grounds that the tax is an invalid use of Congress’ taxing power. So, if the so-called “Free-Rider” provision of the ACA is in fact a tax, then any challenges to it would be premature pursuant to the Anti-Injunction Act because the “tax” in the ACA would not be levied against anyone until 2014 (Section 5000A, which contains the penalty/tax provision, does not go into effect until 2014). Therefore, any lawsuit would have been dismissed because the issue would not have been what is known as “ripe for adjudication” – that is, the plaintiff has not suffered harm or an injury and, consequently, has no standing to bring the suit (the issue of standing is explained in the next paragraph). Thus, it was necessary to determine the issue of whether the individual mandate was a tax or a penalty because if it were a tax, the Supreme Court would never have had a chance to rule on the other issues presented in the lawsuit.

A little background regarding the types of cases the federal courts (including the Supreme Court) can hear is necessary to understanding why the ruling on the Anti-Injunction Act was necessary. There are several requirements which must be met in order for a case to be heard in federal court. Preliminarily, the party bringing the lawsuit must have what is known as “standing” (a requirement set forth in Article III, Section 2, Clause 1 of the United States Constitution). In order to have standing: there must be what is called a “case on controversy” between the parties; the plaintiff must have been actually harmed or injured in some way; and the harm or injury suffered by the plaintiff must be capable of being redressed by the adjudication of the claims set forth in the lawsuit. The purpose of having these requirements is to prevent the federal courts from rendering what are known as “advisory opinions,” that is, opinions on how a lawsuit would turn out if it were to be brought. By limiting the cases which can be heard to cases in which the plaintiff meets these standing requirements, the number of cases heard in federal courts is reduced dramatically. (If there were no standing requirements, anybody could theoretically sue anybody else for anything, regardless of whether they were even affected by it.) The courts exist to settle disputes, so it makes sense there be an actual dispute before the court issues a ruling on the matter.

The Supreme Court (correctly, in my opinion) ruled that the individual mandate was NOT a tax for purposes of the Anti-Injunction Act. Because the mandate was not a tax, the Anti-Injunction Act did not prevent the Supreme Court from hearing and ruling on the rest of the issues in the case. This is the reason Part II of Roberts’ opinion (beginning on page nine) opens with the line, “[b]efore turning to the merits [of the case], we need to be sure we have the authority to do so.” After discussing the arguments for and against the penalty provisions being considered a tax for the purposes of the Anti-Injunction Act, Roberts explained (and the court held), “the Affordable Care Act does not require that the penalty for failing to comply with the individual mandate be treated as a tax for purposes of the Anti-Injunction Act. The Anti-Injunction Act therefore does not apply to this suit, and we may proceed to the merits.” It is extremely important to note here that Roberts specifically rejected the notion that because the penalty functions as a tax, it should be treated as such for purposes of the Anti-Injunction Act. (It will become obvious why after reading Roberts’ decision on the constitutionality of the individual mandate). The analysis literally turned on whether the ACA referred to the penalty as a tax. Because it did not, the Court held the Anti-Injunction Act did not apply.

To sum up this section: The Anti-Injunction Act was found to be inapplicable because even though the Court said the penalty functions as a tax, it is not a tax for purposes of whether the Anti-Injunction Act applied because the ACA does not refer to the penalty as a tax. Thus, the suit was able to proceed on the merits.

The Supreme Court Ruled that the “penalty” in 26 U.S.C. 5000A IS tax for purposes of whether the mandate is constitutional.

The most important yet illogical portion of the opinion involves the constitutionality of the individual mandate. The individual mandate found in the ACA provides that every individual must either purchase health insurance or pay what the ACA calls a penalty. The main argument set forth (by the government and most liberals) was that the mandate is constitutional under Congress’ power to regulate interstate commerce, which is found in Article I, Section 8, Clause 3 (also known as the “Commerce Clause”). The Commerce Clause reads in its entirety: “[The Congress shall have Power] To regulate Commerce with foreign Nations, and among the several States, and with the Indian tribes.” This clause has been used to promulgate all sorts of federal legislation because various Supreme Court decisions have held that Congress has the power to regulate virtually anything which, in the aggregate, has a substantial impact on interstate commerce. Interstate commerce is exactly that: commerce that crosses state lines. Because pretty much anything can be argued to affect interstate commerce, this power of Congress has gone largely unchecked. In one absurdly backwards decision in the 1940s, the Supreme Court even went so far as to say that a farmer who grew his own wheat for his own consumption could be regulated because by not purchasing wheat on the open market, he was affecting interstate commerce. If that seems nonsensical to you, don’t worry – you’re not alone. The key takeaway from the wheat farmer case – as expansive and egregious as it was – is that the government’s power to regulate activity is nearly all-encompassing. However, it crucial to keep in mind that even in such an overreaching case, the government was only able to regulate the wheat farmer’s actual activity. It was not trying to regulate his inactivity. In fact, the government had never before tried regulating inactivity – that is, regulating individuals for not acting. In light of this, it seems rather curious that liberals so forcefully believed and argued that the commerce clause gave Congress the constitutional authority to enact the individual mandate.

Predictably, the four liberals on the Supreme Court (Elena Kagan, Sonia Sotomayor, Ruth Bader-Ginsburg, and Stephen Breyer) accepted the notion that commerce clause gave Congress the power to enact the individual mandate. Thankfully, the other five justices (John Roberts, Antonin Scalia, Clarence Thomas, Samuel Alito, and Anthony Kennedy) refused to follow suit and rejected such a frivolous argument. If they had chosen to go along with the Court’s liberal bloc, it would have been the greatest expansion of Congressional power ever realized. If the Court held that the government has the power to force individuals to act when they do not want to act, then there literally would nothing that the government could not do. That should have been the end of the individual mandate. However, there were two other arguments given in support of the individual mandate’s constitutionality: the Necessary and Proper Clause; and Congress’ taxing power.

The Necessary and Proper Clause is found in Article I, Section 8, Clause 18, and states: “[The Congress shall have Power] To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.” In other words, Congress has the constitutional authority to enact all laws which are necessary to execute its specifically enumerated powers (as set forth in the rest of the Constitution). This argument was specious at best and was not accepted by the Court’s majority. Further exploration of the necessary and proper clause does not add to one’s understanding of the Obamacare ruling and it is not necessary to go into any further detail on this particular argument because it was rejected by the Court.

The third (and least viable) argument for upholding the individual mandate is that it is allowable under Congress’ taxing power. As the dissent pointed out, this argument was rejected by every single court which heard the case. For reasons still being theorized, Chief Justice Roberts upheld the constitutionality of the individual mandate on the basis that it was a valid exercise of Congress’ power to “lay and collect taxes” (a power enumerated in Article 1, Section 8, Clause 1). Again, some background is necessary to understand why this is such a puzzling move. Congress only has the power to “lay and collect taxes” in one of three ways: capitation tax, which is essentially a “head tax,” or a tax levied upon an individual simply for existing (this is such an obscure element of the Constitution and one wrought with so much confusion that Congress hasn’t tried enacting such a tax); excise tax, which is a tax for purchasing a good or service (e.g., cigarette tax, gasoline tax – one can avoid the tax by simply refraining from purchasing the taxed good or service); and the income tax, which only became permissible when the 16th Amendment was ratified and specifically granted Congress the power to enact such a tax. Again, these are the only sources of power with which Congress may impose taxes.

As previously mentioned, Roberts found that the individual mandate was a valid exercise of Congress’ taxing power. In contorting logic, he ruled that the same individual mandate that was not a tax for purposes of the Anti-Injunction Act functioned as tax for constitutional purposes and therefore was indeed a tax, which he then said made the individual mandate constitutional. Again, if you’re confused, you’re not alone. The mandate is not a tax when Roberts doesn’t want it to be and it is a tax when he wants it to be. That’s confounding enough. But what’s worse is that nowhere in the opinion does he state what of the three types of taxes the mandate is. As discussed in the previous paragraph, the tax imposed by Congress must be one of the three enumerated types.

To sum up this section: The individual mandate was held to be a constitutional exercise of Congress’ taxing power even though Roberts never explains which of the three permissible taxes it is. The other arguments made in favor of upholding the law’s constitutionality (the commerce clause and the necessary and proper clause) were rejected by a majority of the Court.

See part II of Faust’s excellent explanation of the ruling HERE.

John Kartch: Five major ObamaCare taxes that will impact you in 2013

There are 21 new taxes in ObamaCare several of which target the chronically ill and disabled – LINK – LINK – LINK.

Six months from now, in January 2013, five major ObamaCare taxes will come into force:

1. The ObamaCare Medical Device Manufacturing Tax

This 2.3 percent tax on medical device makers will raise the price of (for example) every pacemaker, prosthetic limb, stent, and operating table. Can you remind us, Mr. President, how taxing medical devices will reduce the cost of health care? The tax is particularly destructive because it is levied on gross sales and even targets companies who haven’t turned a profit yet.

These are often small, scrappy companies with less than 20 employees who pioneer the next generation of life-prolonging devices. In addition to raising the cost of health care, this $20 billion tax over the next ten years will not help the country’s jobs outlook, as the industry employs nearly 400,000 Americans. Several companies have already responded to the looming tax by cutting research and development budgets and laying off workers.

2. The ObamaCare High Medical Bills Tax

This onerous tax provision will hit Americans facing the highest out-of-pocket medical bills. Currently, Americans are allowed to deduct medical expenses on their 1040 form to the extent the costs exceed 7.5 percent of one’s adjusted gross income.

The new ObamaCare provision will raise that threshold to 10 percent, subjecting patients to a higher tax bill. This tax will hit pre-retirement seniors the hardest. Over the next ten years, affected Americans will pony up a minimum total of $15 billion in taxes thanks to this provision.

3. The ObamaCare Flexible Spending Account Cap

The 24 million Americans who have Flexible Spending Accounts will face a new federally imposed $2,500 annual cap. These pre-tax accounts, which currently have no federal limit, are used to purchase everything from contact lenses to children’s braces. With the cost of braces being as high as $7,200, this tax provision will play an unwelcome role in everyday kitchen-table health care decisions.

The cap will also affect families with special-needs children, whose tuition can be covered using FSA funds. Special-needs tuition can cost up to $14,000 per child per year. This cruel tax provision will limit the options available to such families, all so that the federal government can squeeze an additional $13 billion out of taxpayer pockets over the next ten years.

The targeting of FSAs by President Obama and congressional Democrats is no accident. The progressive left has never been fond of the consumer-driven accounts, which serve as a small roadblock in their long-term drive for a one-size-fits-all government health care bureaucracy.

For further proof, note the ObamaCare “medicine cabinet tax” which since 2011 has barred the 13.5 million Americans with Health Savings Accounts from purchasing over-the-counter medicines with pre-tax funds.

4. The ObamaCare Surtax on Investment Income

Under current law, the capital gains tax rate for all Americans rises from 15 to 20 percent in 2013, while the top dividend rate rises from 15 to 39.6 percent. The new ObamaCare surtax takes the top capital gains rate to 23.8 percent and top dividend rate to 43.4 percent. The tax will take a minimum of $123 billion out of taxpayer pockets over the next ten years.

And, last but not least…

5. The ObamaCare Medicare Payroll Tax increase

This tax soaks employers to the tune of $86 billion over the next ten years.

As you can understand, there is a reason why the authors of ObamaCare wrote the law in such a way that the most brutal tax increases take effect conveniently after the 2012 election. It’s the same reason President Obama, congressional Democrats, and the mainstream media conveniently neglect to mention these taxes and prefer that you simply “move on” after the Supreme Court ruling.

Stroke of Obama’s pen and an entire industry is eliminated

Philip Morris does not like competition, even if it is small time boutique competition that really is no competition at all. In this case a big business and its lobbyists say “JUMP!” in an effort to stick it to a tiny small time competitor and the Congress and the President ask Philip-Morris “How high?” Don’t you wish that your Member of Congress was this responsive to you and our problems? This is why we need new leadership in BOTH parties. Prepare to be made ill by what you are about to read.

They say it is about tax revenues, suuuure, and Philip Morris paid big money to buy off politicians and engage in a massive lobbying effort because, you know, they just can’t stand to see the government maybe miss out on the statistically insignificant lower taxes from roll your own boutique tobacco? Gimme a break. What this is about is a big wealthy company snuffing out a tiny boutique one because the tiny one cannot afford a huge lobbying effort. Anyone who claims that “it’s about taxes” is insulting your intelligence.

There should be a concerted effort to see to it that Boehner is not re-elected Speaker.

Roll-your-own cigarette operations to be snuffed out.

A tiny amendment buried in the federal transportation bill to be signed today by President Barack Obama will put operators of roll-your-own cigarette operations in Las Vegas and nationwide out of business at midnight.

Robert Weissen, with his brothers and other partners, own nine Sin City Cigarette Factory locations in Southern Nevada, including six in Las Vegas, and one in Hawaii. He said when the bill is signed their only choice is to turn off their 20 RYO Filling Station machines and lay off more than 40 employees.

“We’ll stay open for about another week to sell tubes and tobacco just to get through our inventory, but without the use of the RYO machines, we won’t be staying open,” he said.

The machines are used by customers who buy loose tobacco and paper tubes from the shop and then turn out a carton of finished cigarettes in as little as 10 minutes, often varying the blend to suit their taste. Savings are substantial – at $23 per carton, half the cost of a name-brand smoke – in part because loose tobacco is taxed at a lower rate.

“These cigarettes are different because there are benefits in saving money and in how they make you feel,” said Amy Hinds, a partner who operates the Sin City Cigarette Factory at Craig and Decatur.

“These cigarettes don’t have any of the chemicals in them, and the papers are chemical-free, unlike the cartons people buy from Philip Morris.”

But a few paragraphs added to the transportation bill changed the definition of a cigarette manufacturer to cover thousands of roll-your-own operations nationwide. The move, backed by major tobacco companies, is aimed at boosting tax revenues.

Faced with regulation costs that could run to hundreds of thousands of dollars, RYO machine owners nationwide are shutting down more than 1,000 of the $36,000 machines.

“I feel it’s kind of shaky,” Wiessen said. “The man who pushed for this bill is Sen. (Max) Baucus from Montana, and he received donations from Altria, a parent company of Philip Morris. Interestingly enough, there are also no RYO machines in the state of Montana. It really makes me question the morals and values of our elected speakers.”

Sierra Bawden, a single mom with two kids who started rolling her own smokes at Hind’s shop three months ago, said cost is only one factor.

“It saves me time and money, and in the end I feel better because I don’t get all of the chemicals that the other cigarettes have,” Bawden said. “With the brand-name cigarettes, we pay for the chemicals and the name, and I don’t want any of that, so I don’t even know what I’ll do when the shop closes down.”

Megyn Kelly Calls Out Obama: Your lawyer called it a tax in court and now your campaign people are lying about it (video)

Obama and the Democrat Party leadership after saying it was not a tax, directed their lawyers in court to argue that it is a legal tax and now the Obama campaign is saying that they never said it was a tax and that the SDupreme Court got it wrong when they agreed wih the argument form Obama’s own lawyer.

[Actually there are 21 new taxes in ObamaCare several of which target the chronically ill and disabled – LINK – LINK – LINK – Editor]

Allen West on new outrageous federal regulations and the Roberts’ ruling (video)

Water efficiency standards for urinals….

UPDATE – More from Allen West on this issue with Neil Cavuto and the recent preposterous Supreme Court Ruling (video) – LINK

Mark Levin and Megyn Kelly on the Supreme Court: There is no silver lining (video)

This is a must see video and it is short.

Dick Morris: Obama to Sign Gun Control Treaty on July 27! (video)

This is an effort to get around the Second Amendment. In essence some “scholars” who try to reinterpret their way around the Constitution’s limits is going to sign a treaty and send it to the Senate to mandate certain gun control laws.

Oregon Public Teacher: 4th of July “a propaganda campaign that hurts children”…

We have said it time and time again and even though there are mountains of evidence most parents still do not understand; public education has been so radicalized that it has become subversive. Textbooks, many classes and teachers actively push a radical far left indoctrination on the kids and this teacher from Portland is no different. Would anyone like to bet that is is not an Obama voter?

Joe Newby at The Examiner:

According to Portland area teacher Bill Bigelow, July 4th fireworks shows need to be reconsidered, the Education Action Group reported Tuesday.

According to Bigelow, Independence Day “…provides cover for people to blow off fireworks that terrify young children and animals, and that turn the air thick with smoke and errant projectiles. Last year, the fire department here [Portland, OR] reported 172 fires sparked by toy missiles, defective firecrackers, and other items of explosive revelry.”

Bigelow was just getting warmed up.

“Apart from the noise pollution, air pollution, and flying debris pollution, there is something profoundly inappropriate about blowing off fireworks at a time when the United States is waging war with real fireworks around the world. To cite just one example, the Bureau of Investigative Journalism in London found recently that U.S. drone strikes in Pakistan alone have killed more than 200 people, including at least 60 children. And, of course, the U.S. war in Afghanistan drags on and on. The pretend war of celebratory fireworks thus becomes part of a propaganda campaign that inures us—especially the children among us—to the real wars half a world away,” he added.

“Yes, to this ingenious teacher, fireworks promote war. In fact, he says fireworks are ‘pretend war,'” Kyle Olsen wrote.

Olsen reminded readers that the tradition of celebratory fireworks dates back to July 3, 1776, when John Adams suggested in a letter to his wife that the day “ought to be solemnized with pomp and parade, with shows, games, sports, guns, bells, bonfires, and illuminations, from one end of this continent to the other, from this time forward forever more.”

“Is there any vestige of original Americana that Marxist educators won’t seek to erase from our culture?” Olsen asked.

Bigelow, for example, cites a July 1852 speech by Frederick Douglass that decried Independence Day celebrations in a country that had the institution of slavery.

The Oregon teacher said Douglass gave his speech “four years after the United States finished its war against Mexico to steal land and spread slavery, five years before the vicious Supreme Court Dred Scott decision, and nine years before the country would explode into civil war.”

“His words call out through the generations to abandon the empty ‘shout of liberty and equality’ on July 4, and to put away the fireworks and flags,” Bigelow added.

Unfortunately, Bigelow failed to mention that slavery ended in the United States as a result of the conflict.

Olsen says that teachers like Bigelow “would rather make students feel guilty about being Americans than encourage them to appreciate the great things about their nation.”

“If they manage to win their internal war on America by brainwashing too many young minds, we will all be sorry in the very near future,” he concluded.

A Marist poll conducted last year showed that over a quarter of Americans do not know that the original colonies separated from Great Britain. According to the poll, some of the countries mentioned were China, France, Japan, Mexico and Spain.

Ronald Reagan and John Wayne on the 4th of July (video)

Flashback 2008: Obama Trashed Hillary for Proposing Health Care “Penalty” (video)

Via The Blaze:

White House chief of staff Jack Lew repeatedly insisted Sunday that those who fail to buy health insurance will be assessed a “penalty” — not a tax.

But just four years ago, then-candidate Barack Obama ran an ad attacking rival Hillary Clinton for her health plan that it said would do just that.

Obama Denies Waiver for Innovative Cost Saving Indiana Medicaid Program

I mean, we cant have incentives that are deigned to help people make smart health care choices and actually save money, not when we are trying to bankrupt the country…

I first reported on this story on my old college blog when our friend Amity Shleas wrote an article about Obama moving to kill the popular and budget saving program called HIP. Why? Well Mitch Daniels is our governor and the Obama Administration did not want such a successful program written by a popular Republican governor to get any publicity.

Indiana once again tried to save HIP by asking for a waiver and Obama once again is determined to kill the program.

Obama Administration Denies Waiver for Indiana’s Popular Medicaid Program

In 2007, under Gov. Mitch Daniels (R.), Indiana enacted the Healthy Indiana Plan, an expansion of Medicaid that used consumer-driven health plans to encourage low-income beneficiaries to take a more active role in their own care. Today, Healthy Indiana is the most innovative and successful reform of Medicaid in the history of the program. Today, we learn that the Obama Administration has rejected the state’s request to extend its federal waiver, which means that over 45,000 Indianans who get their insurance through the program are out of luck.

Medicaid, of course, is the nation’s government-run health insurance program for the poor. In theory, it’s jointly run by the federal government and the states, but in reality, any time a state wants to make the tiniest changes in its Medicaid program, it has to go hat-in-hand to the U.S. Department of Health and Human Services with a formal request for a waiver, and these waivers are usually denied.

Indiana succeeded in gaining a waiver in 2007 because it was seeking to expand Medicaid to a group of people who weren’t then eligible for the program, and because the state’s effort required no additional outlays from the federal government (the Medicaid expansion was paid for with a 44-cent increase in the state’s cigarette tax.)

Structure of Indiana’s consumer-driven Medicaid plan

Beneficiaries get a high-deductible health plan and a health savings account, called a POWER account, to which individuals must make a mandatory monthly contribution between 2 to 5 percent of income, up to $92 per month. Participants lose their coverage if they don’t make their contributions within 60 days of their due date. After making this contribution, beneficiaries have no other cost-sharing requirements (co-pays, deductibles, etc.) except for non-urgent use of emergency rooms. The state chips in $1,100, which corresponds to the size of the would-be deductible.

Those who have money remaining in their POWER accounts at the end of the year can apply the balance to the following year’s contribution requirements, if they have obtained a specified amount of preventive care: annual physical exams, pap smears and mammograms for women, cholesterol tests, flu shots, blood glucose screens, and tetanus-diphtheria screens.

“We did a lot of reading on criticism of health savings accounts,” says Seema Verma, who was the architect of the Indiana program. “One of the criticisms was that people didn’t have enough money to pay for preventive care. So we took preventive care out, made that first-dollar coverage. Also, people said that people didn’t have enough for the deductible, so we fully funded it. Then, you have to make your contribution every month, with a 60-day grace period. If you don’t make the contribution, you’re out of the program for 12 months. It’s a strong personal responsibility mechanism.”

Indiana’s Medicaid successes

The program has been, by many measures, a smashing success. “What we’re finding out is that, first of all, low-income people are just as capable as anybody else of making wise decisions when it’s their own money that they’re spending,” Mitch Daniels explains in a Heritage Foundation video. “And they’re also acting more like good consumers. They’re visiting emergency rooms less, they’re using more generic drugs, they’re asking for second opinions. And some real money is starting to accumulate in their [health savings] accounts.”

The program has been overwhelmingly popular in Indiana. There’s a large waiting list—in the tens of thousands—to enroll in Healthy Indiana; enrollment was capped in order to ensure that the program’s costs remain predictable. 90 percent of enrollees are making their required monthly contributions. “The program’s level of satisfaction is at an unheard-of 98 percent approval rating,” Verma told Kenneth Artz. Employers didn’t dump their workers onto the program, crowding others out, because you needed to be uninsured for six months in order to be eligible for it.

A 2010 study by Mathematica Policy Research found that the program dramatically increased the percentage of beneficiaries who obtained preventive care, from 39 percent in the first six months of enrollment to 59 percent after one year. Of the members who had money left in the POWER accounts at the end of the year, 71 percent met the preventive care requirement and were able to roll the balances over to the following year. (The remaining 29 percent could roll over their personal contributions, but not the state contributions to their POWER accounts.)

This is an astounding achievement, given that the biggest problem with Medicaid is the way that it ghettoizes its participants, preventing them from gaining access to routine medical and dental care. This lack of physician access is the biggest reason why health outcomes for Medicaid patients lag far behind those of individuals with private insurance, and even behind those with no insurance at all. Healthy Indiana has completely reversed this trend, achieving preventive care participation rates that are higher than the privately-insured population.

Must See Photo of the Year

My dearest friend Tamara De Silva at Timely Objections sent me this amazing picture that is certainly deserving of an award:

Forbes: ObamaCare Responsible for Health Insurance Premium Increases that Tripled in 2011

Higher Health Insurance Premiums This Year? Blame ObamaCare.

Most Americans saw their insurance bills jump this year, according to a new study from the Kaiser Family Foundation. The average employer-based premium for a family increased a startling 9% in 2011. Over the next decade, rates are expected to double.

The Kaiser report is only the latest piece of research to indicate that ObamaCare isn’t driving down health care costs, as its proponents promised, but is instead accelerating their rise.

This year, the average premium for a family hit $15,073 — $1,303, or 9%, higher than the year before. And that’s on top of increases of 5% in 2009 and 3% in 2010.

Employees are picking up a substantial portion of that tab. They paid an average of $4,129 for their family insurance premiums this year — more than double what they shelled out 10 years ago. And that figure doesn’t include out-of-pocket health expenses.

These premium hikes have outpaced general inflation and salary increases — and thus are swallowing a greater share of American households’ budgets. A study published in the September 2011 issue of Health Affairs found that burgeoning health costs have decimated nearly an entire decade’s worth of income gains. In 2009, the average American family had just $95 more to spend at will than it did in 1999.

Worse, there’s no relief in sight. Next year, employers expect premiums to rise 7.2%, according to the National Business Group on Health.

Over the next ten years, American families can expect rising health costs to continue to offset pay raises. According to the Kaiser study, premiums are set to reach a whopping $32,175 by 2021. And more than 50% of employers have stated that they plan to shift a greater share of health-insurance costs onto their employees.

ObamaCare is to blame for much of these impending increases. Richard Foster, the Chief Actuary for the Centers for Medicare and Medicaid Services (CMS), reports that America will spend an additional $311 billion on health care in the next decade because of the law.

CMS estimates the growth in health insurance costs will increase 10 extra percentage points in 2014 because of ObamaCare — a 14% increase, versus 3.5% without the law.

ObamaCare drives up the cost of insurance by piling mandates and required coverage benefits onto every single policy.

“The Lemon” – Why Canada Is Now Reforming Their Socialized Health Care System (video)

….and moving back to privatization.

British Socialized Health Service Kills Off 130,000 Elderly Every Year

And Obama tried to appoint Don Berwick as a senior HHS official who believed that the British socialized rationed system was “the” model.

The NHS kills off 130,000 elderly patients every year

- Professor says doctors use ‘death pathway’ to euthenasia of the elderly

- Treatment on average brings a patient to death in 33 hours

- Around 29 per cent of patients that die in hospital are on controversial ‘care pathway’

NHS doctors are prematurely ending the lives of thousands of elderly hospital patients because they are difficult to manage or to free up beds, a senior consultant claimed yesterday.

Professor Patrick Pullicino said doctors had turned the use of a controversial ‘death pathway’ into the equivalent of euthanasia of the elderly.

He claimed there was often a lack of clear evidence for initiating the Liverpool Care Pathway, a method of looking after terminally ill patients that is used in hospitals across the country.

It is designed to come into force when doctors believe it is impossible for a patient to recover and death is imminent.

It can include withdrawal of treatment – including the provision of water and nourishment by tube – and on average brings a patient to death in 33 hours.

There are around 450,000 deaths in Britain each year of people who are in hospital or under NHS care. Around 29 per cent – 130,000 – are of patients who were on the LCP.

Professor Pullicino claimed that far too often elderly patients who could live longer are placed on the LCP and it had now become an ‘assisted death pathway rather than a care pathway’.

He cited ‘pressure on beds and difficulty with nursing confused or difficult-to-manage elderly patients’ as factors.

Professor Pullicino revealed he had personally intervened to take a patient off the LCP who went on to be successfully treated.

He said this showed that claims they had hours or days left are ‘palpably false’.

In the example he revealed a 71-year-old who was admitted to hospital suffering from pneumonia and epilepsy was put on the LCP by a covering doctor on a weekend shift.

Professor Pullicino said he had returned to work after a weekend to find the patient unresponsive and his family upset because they had not agreed to place him on the LCP.

‘I removed the patient from the LCP despite significant resistance,’ he said.

‘His seizures came under control and four weeks later he was discharged home to his family,’ he said

Read more: http://www.dailymail.co.uk/news/article-2161869/Top-doctors-chilling-claim-The-NHS-kills-130-000-elderly-patients-year.html#ixzz1zVNAucT9

IBD: 21 ObamaCare Taxes Already Causing Job Losses

Here is another source for the list of 21 ObamaCare taxes coming your way courtesy of Investors Business Daily:

Taxation: The high bench has confirmed that ObamaCare’s individual mandate is a massive tax on the American middle class. But let’s not forget the 20 other new taxes that are embedded in the law.

Though President Obama never sold it as a tax hike, the Supreme Court ruled the mandate is exactly that. Unfortunately, the majority argued it’s legal under Congress’ taxing authority.

Forcing citizens to buy health insurance “is absolutely not a tax increase,” Obama insisted in 2009. Earlier, he assured the public that raising taxes on the middle class to support his health care plan was “the last thing we need in an economy like this.” “Folks are already having a tough enough time,” Obama added.

Indeed they are. But his plan, which subsidizes some 30 million uninsured, amounts to a $1.8 trillion whammy on working families. And that’s just for starters.

The court was silent about the 20 other different taxes hidden in ObamaCare, more than half of which affect families earning less than $250,000 a year.

The new taxes, which cost some $675 billion over the next decade, include:

• A 2.3% excise tax on U.S. sales of medical devices that’s already devastating the medical supply industry and its workforce. The levy is a $20 billion blow to an industry that employs roughly 400,000.

Several major manufacturers have been roiled, including: Michigan-based Stryker Corp., which blames the tax for 1,000 layoffs; Indiana-based Zimmer Corp., which cites the tax in laying off 450 and taking a $50 million charge against earnings; Indiana-based Cook Medical Inc., which has scrubbed plans to open a U.S. factory; Minnesota-based Medtronic Inc., which expects an annual charge against earnings of $175 million, and Boston Scientific Corp., which has opted to open plants in tax-friendlier Ireland and China to help offset a $100 million charge against earnings.

• A 3.8% surtax on investment income from capital gains and dividends that applies to single filers earning more than $200,000 and married couples filing jointly earning more than $250,000.

• A $50,000 excise tax on charitable hospitals that fail to meet new “community health assessment needs,” “financial assistance” and other rules set by the Health and Human Services Dept.

• A $24 billion tax on the paper industry to control a pollutant known as black liquor.

• A $2.3 billion-a-year tax on drug companies.

• A 10% excise tax on indoor tanning salons.

• An $87 billion hike in Medicare payroll taxes for employees, as well as the self-employed.

• A hike in the threshold for writing off medical expenses to 10% of adjusted gross income from 7.5%.

• A new cap on flexible spending accounts of $2,500 a year.

• Elimination of the tax deduction for employer-provided prescription drug coverage for Medicare recipients.

• An income surtax of 1% of adjusted gross income, rising to 2.5% by 2016, on individuals who refuse to go along with ObamaCare by buying a policy not OK’d by the government.

• A $2,000 tax charged to employers with 50 or more workers for every full-time worker not offered health coverage.

• A $60 billion tax on health insurers.

• A 40% excise tax on so-called Cadillac, or higher cost, health insurance plans.

All told, there are 21 new or higher taxes imposed by Obama’s health care law — and 21 more reasons to repeal it.

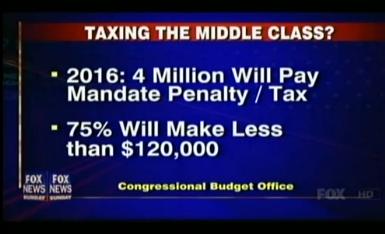

WSJ Chief Economist: 75% of all ObamaCare taxes impact those who make less than $120,000 a year (video)

“It’s a big punch in the stomach to middle class families.” – Stephen Moore, WSJ Chief Economist

Via Human Events:

Take Your Medicine, America…

Stephen Moore, Senior Economics Writer with the Wall Street Journal, told FOX and Friends this morning that nearly 75% of Obamacare costs will fall on the backs of those Americans making less than $120,000 a year.

It is true and the CBO confirmed it:

Jim Hoft comments on the following video where the White House Chief of Staff was trying to lie about the Supreme Court ruling, and then lied about it being some form of tax. So Fox News’ Chris Wallace played the audio from Obama’s Lawyer in the Supreme Court saying it is a tax. It is clear that the Obama Administration plan is to lie about ObamaCare and lie about the tax.

In the video below the White House calls those who pay the penalty tax “free riders”, because they will have to pay because of all of the new taxes ObamaCare puts on health insurance and care which will price health insurance out of the reach of the young and the working lower middle class. They are not the free riders, the young and working poor/middle class aren’t getting anything, they are the ones who are PAYING! The free riders are the few who will get their health insurance subsidized in part from that money paid. They are the free riders because they are getting at least a part of their insurance paid for by others who are forced to pay the penalty because they can’t afford health insurance any longer under ObamaCare mandates and taxes which are already causing rates to skyrocket.

Democrats told us Obamacare was not a tax.

Then they argued in front of the Supreme Court that it was a tax.

Now they want to tell us again that Obamacare is not a tax.Jack Lew, the Obama White House Chief of Staff, was trying to persuade Chris Wallace on FOX News Sunday that Obamacare was not a tax. But it didn’t work out so well for Lew when Wallace played audio of the Obama lawyer arguing that Obamacare was a tax in front of the Supreme Court.

Lew was stunned after being caught in the lie.

At least 7 new ObamaCare taxes directly impact the poor, middle class and the disabled

Yes that is right, some of the taxes target families with disabled children.

While we were all debating the cost to our liberty due to the Patient Protection and Affordable Care Act (Obamacare), we were ignoring the cost to our pockets. If there ever was a reason for bipartisan rage about this law, it should be on the twenty – yes, twenty – hidden new taxes of this law. Making matters even more relevant is that seven of these taxes are levied on all citizens regardless of income. Hence, Mr. Obama’s promise not to raise taxes on anyone earning less than $250,000 is just another falsehood associated with this legislation.

The first, and best known, of these seven taxes that will hit all Americans as a result of Obamacare is the Individual Mandate Tax (no longer concealed as a penalty). This provision will require a couple to pay the higher of a base tax of $1,360 per year, or 2.5% of adjusted growth income starting with lower base tax and rising to this level by 2016. Individuals will see a base tax of $695 and families a base tax of $2,085 per year by 2016.

[The following taxes affect those who have disabled family members disproportionately – Political Arena Editor]

Next up is the Medicine Cabinet Tax that took effect in 2011. This tax prohibits reimbursement of expenses for over-the-counter medicine, with the lone exception of insulin, from an employee’s pre-tax dollar funded Health Saving Account (HSA), Flexible Spending Account (FSA) or Health Reimbursement Account (HRA). This provision hurts middle class earners particularly hard since they earn enough to actually pay federal taxes, but not enough to make this restriction negligible.

The Flexible Spending Account (FSA) Cap, which will begin in 2013, is perhaps the most hurtful provision to the middle class. This part of the law imposes a cap of $2,500 per year (which is now unlimited) on the amount of pre-tax dollars that could be deposited into these accounts. Why is this particularly hurtful to the middle class? It is because funds in these accounts may be used to pay for special needs education for special needs children in the United States. Tuition rates for this type of special education can easily exceed $14,000 per year and the use of pre-tax dollars has helped many middle income families.

Another direct hit to the middle class is the Medical Itemized Deduction Hurdle which is currently 7.5% of adjusted gross income. This is the hurdle that must be met before medical expenses over that hurdle can be taken as a deduction on federal income taxes. Obamacare raises this hurdle to 10% of adjusted gross income beginning in 2013. Consider the middle class family with $80,000 of adjusted gross income and $8,000 of medical expenses. Currently, that family can get some relief from being able to take a $2,000 deduction (7.5% X $80,000 = $6,000; $8,000 –$6,000 = $2,000). An increase to 10% would eliminate the deduction in this example and if that family was paying a 25% federal tax rate, the real cost of that lost deduction would be $500.

Continue reading about other new ObamaCare taxes HERE.

Why Are Health Insurance Premiums Increasing Faster After ObamaCare Passed?