Instead they are using these problems as “crisis opportunities” to increase government power and enrich their friends.

$3.59 – When Barack Obama entered the White House, the average price of a gallon of gasoline was $1.85. Today, it is $3.59.

22 – It is hard to believe, but today the poverty rate for children living in the United States is a whopping 22 percent.

23 – According to U.S. Representative Betty Sutton, an average of 23 manufacturing facilities permanently shut down in the United States every single day during 2010.

30 – Back in 2007, about 10 percent of all unemployed Americans had been out of work for 52 weeks or longer. Today, that number is above 30 percent.

32 – The amount of money that the federal government gives directly to Americans has increased by 32 percent since Barack Obama entered the White House.

35 – U.S. housing prices are now down a total of 35 percent from the peak of the housing bubble.

40 – The official U.S. unemployment rate has been above 8 percent for 40 months in a row.

42 – According to one survey, 42 percent of all American workers are currently living paycheck to paycheck.

48 – Shockingly, at this point 48 percent of all Americans are either considered to be “low income” or are living in poverty.

49 – Today, an astounding 49.1 percent of all Americans live in a home where at least one person receives benefits from the government.

53 – Last year, an astounding 53 percent of all U.S. college graduates under the age of 25 were either unemployed or underemployed.

60 – According to a recent Gallup poll, only 60 percent of all Americans say that they have enough money to live comfortably.

61 – At this point the Federal Reserve is essentially monetizing much of the U.S. national debt. For example, the Federal Reserve bought up approximately 61 percent of all government debt issued by the U.S. Treasury Department during 2011.

63 – One recent survey found that 63 percent of all Americans believe that the U.S. economic model is broken.

71 – Today, 71 percent of all small business owners believe that the U.S. economy is still in a recession.

80 – Americans buy 80 percent of the pain pills sold on the entire globe each year.

81 – Credit card debt among Americans in the 25 to 34 year old age bracket has risen by 81 percent since 1989.

85 – 85 percent of all artificial Christmas trees are made in China.

86 – According to one survey, 86 percent of Americans workers in their sixties say that they will continue working past their 65th birthday.

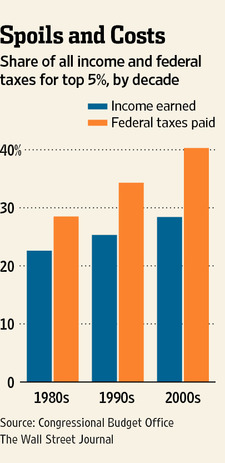

90 – In the United States today, the wealthiest one percent of all Americans have a greater net worth than the bottom 90 percent combined.

93 – The United States now ranks 93rd in the world in income inequality.

95 – The middle class continues to shrink – 95 percent of the jobs lost during the last recession were middle class jobs.

107 – Each year, the average American must work 107 days just to make enough money to pay local, state and federal taxes.

350 – The average CEO now makes approximately 350 times as much as the average American worker makes.

400 – According to Forbes, the 400 wealthiest Americans have more wealth than the bottom 150 million Americans combined.

$500 – In some areas of Detroit, Michigan you can buy a three bedroom home for just $500.

627 – In 2010, China produced 627 million metric tons of steel. The United States only produced 80 million metric tons of steel.

877 – 20,000 workers recently applied for just 877 jobs at a Hyundai plant in Montgomery, Alabama.

900 – Auto parts exports from China to the United States have increased by more than 900 percent since the year 2000.

$1580 – When Barack Obama first took office, an ounce of gold was going for about $850. Today an ounce of gold costs more than $1580 an ounce.

1700 – Consumer debt in America has risen by a whopping 1700% since 1971.

2016 – It is being projected that the Chinese economy will be larger than the U.S. economy by the year 2016.

$4155 – The average American household spent a staggering $4,155 on gasoline during 2011.

$4300 – The amount by which real median household income has declined since Barack Obama entered the White House.

$6000 – If you can believe it, the median price of a home in Detroit is now just $6000.

$10,000 – According to the Employee Benefit Research Institute, 46 percent of all American workers have less than $10,000 saved for retirement, and 29 percent of all American workers have less than $1,000 saved for retirement.

49,000 – In 2011, our trade deficit with China was more than 49,000 times larger than it was back in 1985.

50,000 – The United States has lost an average of approximately 50,000 manufacturing jobs a month since China joined the World Trade Organization in 2001.

56,000 – The United States has lost more than 56,000 manufacturing facilities since 2001.

$85,000 – According to the New York Times, a Jeep Grand Cherokee that costs $27,490 in the United States costs about $85,000 in China thanks to all the tariffs.

$175,587 – The Obama administration spent $175,587 to find out if cocaine causes Japanese quail to engage in sexually risky behavior.

$328,404 – Over the next 75 years, Medicare is facing unfunded liabilities of more than 38 trillion dollars. That comes to $328,404 for each and every household in the United States.

$361,330 – This is what the average banker in New York City made in 2010.

440,00 – If the federal government began right at this moment to repay the U.S. national debt at a rate of one dollar per second, it would take over 440,000 years to totally pay it off.

500,000 – According to the Economic Policy Institute, America is losing half a million jobs to China every single year.

2,000,000 – Family farms are being systematically wiped out of existence in the United States. According to the U.S. Department of Agriculture, the number of farms in the United States has fallen from about 6.8 million in 1935 to only about 2 million today.

$2,000,000 – At this point, the U.S. national debt is rising by more than 2 million dollars every single minute.

2,600,000 – In 2010, 2.6 million more Americans fell into poverty. That was the largest increase that we have seen since the U.S. government began keeping statistics on this back in 1959.

5,400,000 – When Barack Obama first took office there were 2.7 million long-term unemployed Americans. Today there are twice as many.

16,000,000 – It is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls.

$20,000,000 – The amount of money the U.S. government was spending to create a version of Sesame Street for children in Pakistan.

25,000,000 – Today, approximately 25 million American adults are living with their parents.

40,000,000 – According to Professor Alan Blinder of Princeton University, 40 million more U.S. jobs could be sent offshore over the next two decades if current trends continue.

46,405,204 – The number of Americans currently on food stamps. When Barack Obama first entered the White House there were only 32 million Americans on food stamps.

88,000,000 – Today there are more than 88 million working age Americans that are not employed and that are not looking for employment. That is an all-time record high.

100,000,000 – Overall, there are more than 100 million working age Americans that do not currently have jobs.

$150,000,000 – This is approximately the amount of money that the Obama administration and the U.S. Congress are stealing from future generations of Americans every single hour.

$2,000,000,000 – The amount of money that JP Morgan has admitted that it will lose from derivatives trades gone bad. Many analysts are convinced that the real number will actually end up being much higher.

$147,000,000,000 – In the U.S., medical costs related to obesity are estimated to be approximately 147 billion dollars a year.

295,500,000,000 – Our trade deficit with China in 2011 was $295.5 billion. That was the largest trade deficit that one country has had with another country in the history of the planet.

$359,100,000,000 – During the first quarter of 2012, U.S. public debt rose by 359.1 billion dollars. U.S. GDP only rose by 142.4 billion dollars.

$454,000,000,000 – During fiscal 2011, the U.S. government spent over 454 billion dollars just on interest on the national debt.

$1,000,000,000,000 – The total amount of student loan debt in the United States recently surpassed the one trillion dollar mark.

$1,170,000,000,000 – China now holds approximately 1.17 trillion dollars of U.S. government debt. Yet the U.S. government continues to send them millions of dollars in foreign aid every year.

$1,600,000,000,000 – The amount that has been added to the U.S. national debt since the Republicans took control of the U.S. House of Representatives. This is more than the first 97 Congresses added to the national debt combined.

$5,000,000,000,000 – The U.S. national debt has risen by more than 5 trillion dollars since the day that Barack Obama first took office. In a little more than 3 years Obama has added more to the national debt than the first 41 presidents combined.

$5,000,000,000,000 – What the real U.S. budget deficit in 2011 would have been if the federal government had used generally accepted accounting principles.

$11,440,000,000,000 – The total amount of consumer debt in the United States.

$15,734,596,578,458.59 – The U.S. national debt as of June 7, 2012.

$200,000,000,000,000 – Today, the 9 largest banks in the United States have a total of more than 200 trillion dollars of exposure to derivatives. When the derivatives market completely collapses there won’t be enough money in the entire world to fix it.