You know that the elite media in the United States has failed us when Russia Today (AKA “RT”) – the mouthpiece for Vladimir Putin – gives the best analysis I have yet seen on a major network (granted RT isn’t huge in the United States, but around the world it is). Russia Today not only explains why the Roberts ruling is preposterous as a matter of law, and then explains several of the economic consequences of ObamaCare. This very writer has called out Russia Today as a mouthpiece for Putin before, but with that said, in this segment Russia Today displays one of the finest pieces of television journalism I have ever seen.

Russia Today has an agenda of showing the United States as authoritarian, silly, corrupt, willing to break its own laws, and anything but small government. Russia Today doesn’t have to make it up any more with the Obama Administration because all they have to do is highlight and accurately cover the stories the elite media will not to accomplish Putin’s goals.

Our friend Samantha Frederickson has a GREAT post explaining the consequences of ObamaCare that will impact you after the clip from Russia Today below. Start the video at the 2:00 mark:

Now consider this — the PPACA sets forth a “fine” (tax) of $2,000 per employee for a business that has 50 or more and does not provide “at least” the minimum “insurance” to all.

There is no health care plan I’m aware of that a business can buy today that costs less than $2,000 per employee per year, and which also meets the requirements in the law. None. That was almost impossible to meet back in 1995 for a healthy, 18 year old insured single male. It’s flatly impossible now and it’s doubly-so if your workforce has other than 18-year old single, healthy males in it. I know this to be factual because I was responsible for buying it for our employees as a CEO of a company.

Therefore the incentive is for all businesses to drop health care.

Period.

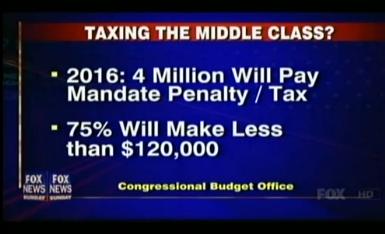

Second, your choice is to either (1) buy and have said plan (whether through employment or individually) or pay a “fine” (tax) of 1% of income (increasing to 2.5% of AGI in 2016.) The minimum “fine” is $95 starting in 2013, rising to $695 in 2016. The average family income is about $50,000/year, which means that the fine (tax) will be $1,250 in 2016. It’s less now.

You cannot buy health insurance at their “minimum level” for anything approaching $1,250 a year no matter how healthy you are at any age.

The law prohibits insurance companies from charging you more if you’re sick, or refusing to cover you at all. They must accept everyone on equal terms.

Therefore:

- Businesses will drop coverage; it’s cheaper (by far) for them to pay the fine and, for those under 133% of the federal poverty level, those employees can go onto Medicaid. This is a “family of four” income of $31,900 (as of today; it will go up of course.) That’s roughly the second quintile.

- Individuals will drop coverage and pay the fine, since it’s far cheaper than to buy the “insurance.”

Both will buy the “insurance” only when they get sick, since they cannot be upcharged.

The cost of “insurance” will thus skyrocket to 10x or more what it costs now, just as it would if you bought auto insurance only after you wrecked or homeowners insurance only after you had a fire.

At the higher price nobody will be able to afford to buy the insurance at all, since that will be indistinguishable from just paying for whatever is wrong with you, plus the insurance company markup.

In very short order the entire medical system and health insurance scheme will collapse, leaving only two choices — either a return to free market principles (including all I’ve argued for since this debate began) or a single-payer, fully-socialized system ala Canada.

You can bet the government will continue to try to change the terms of the deal — including ramping up the tax/fine and other games, to prevent this outcome, but they will fail.

Now the question becomes this:

Which Presidential political candidates have told you the above, and what are their answers to this dilemma?

Let’s go down the list.

- We know what Obama’s is — he passed it. You will lose your private health care under Obama. Period. We are headed for a fully-socialized medical system and a collapse of the current medical paradigm under Obama.

- We know what Gary Johnson’s position is — he wants to “block grant” all Medicare and Medicaid to the states, cut the amount of money in the budget (all line items) 43% and repeal Obamacare (including the mandate.) But he refuses to demand an end to the cost-shifting where Juanita the illegal Mexican immigrant who is 7-1/2 months pregnant while drug and alcohol dependent shows up in the hospital, in labor, and foists off a $2.5 million NICU and birth expense bill on you! He also refuses to stop the drug companies from effectively forcing Americans to bear the cost of all drug and device development and he has refused to put a stop to differential billing. The latter two only exist because of explicit federal laws that make lawful in the health industry market behaviors that are illegal in virtually every other line of work (see The Sherman Act, The Clayton Act, and Robinson-Patman for starters.) All of these facts are why the costs are ramping in the first place, which means his plan will simply force the States into bankruptcy and continue screwing you at the same time.

- We don’t know what Romney’s plan is in detail. He’s been oddly silent in that regard. He says “Obamacare is not the answer” but he passed it as Governor on a state basis! He too advocates nothing to put a stop to the cost-shifting and anti-competitive acts of drug and device makers nor hospitals and other medical providers. He too wants to block grant Medicaid but that does nothing to address the problem and will simply bankrupt the state budgets (as noted for Johnson.) Conspicuously absent from Romney’s plan (as is true for Johnson) is (1) a repeal of EMTALA, (2) a demand for level, consistent pricing irrespective of how one pays for a service (3) and a demand to remove anti-competitive laws protecting differential billing across state and national boundaries (e.g. Viagra for $2 in Canada .vs. $20 here) so that Americans are not forced to subsdize everyone else in the world and you pay the same price as the guy next to you in the hospital for the same product or service, instead of 2x, 3x, 5x, or even 100x as much.

So we have three Presidential candidates, none of which will do a damn thing to fix what’s wrong with health care. All three are promoting a path that will bankrupt the States, bankrupt the Federal Government, bankrupt you or all three.

All three are promoting mathematical impossibilities. All three are protecting monopolistic behavior and refusing to address specific laws that were passed to protect that behavior and special government-granted privilege; without those protections that monopolistic behavior would immediately collapse.

And worse, none of them has proposed a damn thing to deal with what the Supreme Court just did, which is grant a permanent ability to the Federal Government to compel any behavior by linking it to a tax. Some examples of where this can (and might in the near future!) go include:

- You make cars. You’re told to sell a car to anyone who makes under $25,000 a year for $5,000. This is of course under your cost of production. If you refuse, every car you make is subject to a $5,000 tax. This is now Constitutional, as of this last week.

- You would like to have three kids. The government decides that you may have only two. If you have get pregnant with a third and refuse to have an abortion you must pay $10,000 a year in additional tax forever. This is now Constitutional, as of last week.

- You may have all the abortions you want, but each costs $10,000 in tax. This is Constitutional, as of last week.

- You must eat Broccoli and submit receipts with your 1040 proving you bought 1lb of Broccoli per person in your household per week. If you do not, you must pay $5,000 in additional tax. This is Constitutional, as of last week.

- If you are more than 10lbs overweight you must pay $2,000 of additional tax for every 10lbs overweight you are, with no cap. This is Constitutional, as of last week.

You probably think I’m kidding on this. I’m not. This is what the Roberts Court held. There is literally nothing that Congress cannot mandate that you do, or not do, under penalty of paying a tax. All that was unconstitutional before the ruling now is explicitly constitutional if the only “compulsion” to do (or not do) a given thing is that you will be taxed if you refuse. The court promised to review “reasonableness” of any such taxes in the future, but note that at the same time the court ignored two other problems with the Health Care law, making a lie of their claim of “future reasonableness” tests right up front:

- Direct taxes are unconstitutional without being apportioned. This is clearly a direct tax and it is not apportioned. It is therefore unconstitutional, but the USSC simply ignored this. (The 16th Amendment was required to make income taxes constitutional for this reason.)

- The Anti-Injunction Act prohibits suing the government over a tax until you have actually paid it. This means that if the PPACA “penalty” is a tax then the entire lawsuit that went to the USSC is moot as it’s not yet “ripe” (since nobody has yet paid the tax.) If they were going to find that this was a tax they were thus bound to dismiss the entire complaint as unripe. They ignored that too.

In short the USSC has become no more legitimate than the North Korean government and is unworthy of your respect.